Baker Tilly was asked by the customer to take over their bookkeeping at the best and most efficient price

The customer’s challenge was that several of their processes had to be carried out manually, including bookkeeping, bank entries, creditor, and payment.

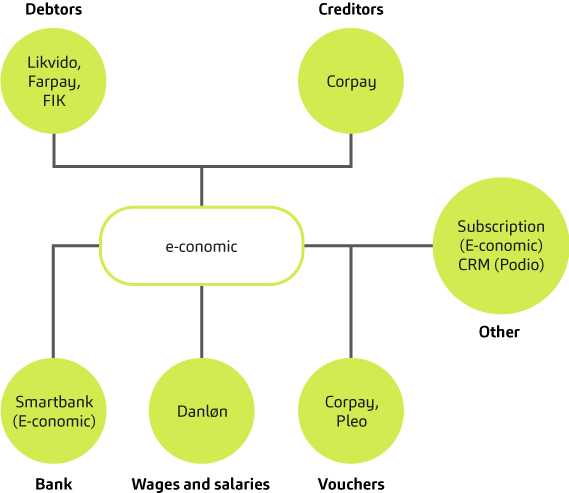

At Baker Tilly, we advised the customer to implement new automated bookkeeping with e-conomic as the financial system and connect several third-party solutions for various purposes.

Baker Tilly's proposal for automated bookkeeping

Advantages of automated bookkeeping

- Corpay creates independence between the business and bookkeeping. In addition, Corpay handles all creditors for an automatic bank reconciliation via SmartBank. This creates a structure of creditors and creditor payments, and the bookkeeping is done completely automatically.

Example: The customer used to spend a lot of time on both the accountants and the director handling invoices from creditors. The invoices had to go through the director several times a day and through the bank. With Baker Tilly's solution, the bank becomes redundant. The invoices simply must be approved by the director, whose approval both pays and recognises the invoice.

- With the help of FarPay, the flow of reminders has been automated - The system can keep track of whether the customer has paid the invoice and when to send a reminder if the payment has not taken place.

When the reminders are sent out on time, the payment options increase, which means that the customer experiences a much better cash flow.